19 Sept 2023

Introduction:

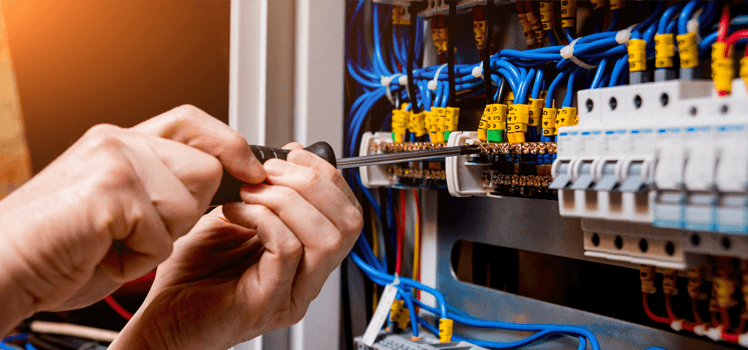

Ensuring a safe working environment is crucial for any business, and one area that demands careful attention is electrical safety. In the United Kingdom, workplace accidents related to electricity can result in significant financial losses, legal liabilities, and reputational damage. This is where insurance can play a vital role in mitigating risks and protecting both businesses and employees. In this article, we will explore the importance of electrical safety in the workplace and how insurance can help UK companies safeguard their interests.

The Significance of Electrical Safety:

Electrical hazards pose a real threat to the well-being of employees and the overall operational continuity of businesses. Faulty wiring, inadequate maintenance, or improper use of electrical equipment can lead to fires, electrocutions, and serious injuries. The Health and Safety Executive (HSE) in the UK highlights that every year, a significant number of accidents occur due to electric shocks and burns, underscoring the need for stringent safety measures.

Preventive Measures and Compliance:

Effective prevention starts with a comprehensive electrical safety program. Companies should conduct regular risk assessments and inspections to identify potential hazards. Adequate training, along with clearly documented procedures and protocols, should be provided to employees. Compliance with the Electricity at Work Regulations 1989, a legal requirement in the UK, is essential. These regulations outline the responsibilities of employers and employees, covering aspects such as system design, installation, and maintenance.

Insurance Coverage for Electrical Safety:

Insurance serves as a safety net, providing financial protection and minimizing the potential liabilities associated with electrical accidents. Here are key insurance policies that UK companies should consider for electrical safety:

1. Employer's Liability Insurance: This coverage is legally mandatory in the UK and protects businesses against claims resulting from employee injuries or illnesses caused by electrical accidents at work.

2. Public Liability Insurance: This policy safeguards companies in case a third party, such as a visitor or contractor, suffers harm or property damage due to an electrical incident on the premises.

3. Property Insurance: As electrical accidents may result in fire or equipment damage, having property insurance in place can help cover the cost of repairs or replacements.

4. Business Interruption Insurance: Electrical accidents can cause significant disruptions to operations. Business interruption insurance compensates for lost income, ongoing expenses, and helps mitigate financial losses during the recovery period.

5. Product Liability Insurance: If a company designs, manufactures, or supplies electrical equipment, product liability insurance provides coverage against claims arising from defects or malfunctions that result in harm to users.

Partnering with an Experienced Insurer:

When selecting an insurance provider, UK companies should seek those with experience and expertise in electrical safety. Insurers familiar with industry-specific risks can better assess the coverage required and offer valuable guidance to ensure adequate protection.

Conclusion:

Electrical safety should be a priority for UK companies, not only for fulfilling legal obligations but also for safeguarding their employees and business interests. By implementing preventive measures, complying with regulations, and securing appropriate insurance coverage, businesses can effectively mitigate risks associated with electrical hazards in the workplace. Prioritizing safety today will lead to a resilient future, protecting both employees and the long-term success of the organization.